By Susan Reidy

September 2021

Digitization transforms

commodity markets

Electronic trading technology ended 150-plus years of open outcry buying and selling and has potential to transform the grain elevator’s role.

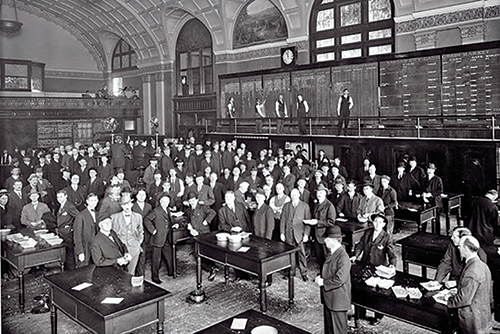

Photo courtesy of CBOT records: Series V – Public Relations Department.

From the sidelines of the Chicago Board of Trade trading floor in the early 2000s, Tanner Ehmke, then a reporter for Dow, witnessed the beginning of the end of open outcry trading.

“I was there to watch the day when the electronic platform went online and started trading side-by-side with open outcry,” said Ehmke, who is now a CoBank lead economist for dairy and specialty crops. “You could see open outcry disappear right before your eyes.”

The appeal of anonymity with electronic trading along with the speed, cost savings and boundless opportunities meant the technology quickly gained ground.

Exchanges around the world that used the open outcry system for more than 150 years closed their trading pits and pushed toward digitization. Buying and selling that used to be done in pits by traders in brightly colored jackets, holding tickets, and shouting orders back and forth, is now done around the world with a click of a computer or the touch of a phone screen.

“The change from open outcry pit trading to electronic trading in the last 15 years is the biggest technical change in modern futures trading in the last 150 years,” said Scott Irwin, Laurence J. Norton Chair of Agricultural Marketing, University of Illinois, Urbana-Champaign.

The exchanges themselves developed in the mid-19th century as a central market for delivery, sale and purchase of commodities. Traders could meet face-to-face and make verbal contracts for the future delivery of crops such as corn, soybeans and wheat. It helped insulate the producers and consumers from drastic seasonal and supply fluctuations that were common during that time.

Exchanges emerged in cities along navigable waterways — Chicago, Kansas City, Minneapolis and New York City. In the following century, new technology such as the telegraph and telephone, improved trading, especially from off-site locations. But it wasn’t until electronic trading in the 1990s and beyond, that exchanges started eliminating trading floors and consolidating operations. With the CME closing its trading pits this year, open outcry for agriculture commodities came to an end.

Looking to the future and possible disruptors, the use of blockchain for trading hasn’t taken off as some industry experts thought it would. Still, digitization is having ripple effects throughout the supply chain and leading to a changing role for grain elevators as farmers become savvier at marketing their own bushels. There’s also been the birth of new technology companies such as Covantis and Agriota that seek to modernize and streamline trade and post-trade activities.

“A lot has changed just in the last 20 years,” Ehmke said. “I wouldn’t say the pace of change is slowing; there will continue to be new innovations that will expedite these trends of consolidation and faster and lighter trading platforms. You can bet on that any day of the week.”

While some form of futures trading can be traced back to ancient Greek and Phoenician merchants who sold their goods throughout the world, the modern globally traded futures markets have their origins in the 19th century United States, according to CME Group.

Commodity markets arose as increasing agricultural production and consumption required a central market for delivery, sale and purchase.

Agricultural producers and consumers experienced drastic seasonal and supply fluctuation, gluts and shortages and tumultuous price fluctuations, CME said. At a time when storage facilities were primitive and the markets were disorganized, hubs of agricultural commerce started to emerge in cities located around navigable US waterways.

By 1848, canal and railroad infrastructure linked the Great Lakes with the Mississippi River, making Chicago, Illinois, an ideal location for agricultural commerce. Agricultural production was shifting west of the Mississippi and Ohio rivers, but the major population growth was happening on the East Coast.

“There had to be a system developed to get grain from the heartland back to the East Coast,” Irwin said. “Chicago became a major transshipment point for connecting grain from individual farmers to a central place where it could be shipped by barge or rail. That was a natural place where futures trading would start to occur. A lot of people were dealing in a lot of forward contracts because of the physical movement through Chicago.”

The Chicago Board of Trade (CBOT) formed as a cash market for grain in 1848. Creation of a central grain exchange allowed farmers and grain producers to sell crops at set prices in the months between harvests and allowed consumers to buy grains at transparent prices throughout the year, CME said.

Standardized futures contracts were introduced by CBOT in 1865, introducing a level of reliability and security to buyers and sellers that stabilized markets against possible default, CME said.

“There’s always people wanting to adjust their price exposure in this forward contract market, so why not create a market that allows people to trade in and out of the long and short side of forward contracts,” Irwin said. “That’s the idea of a future market.

“The whole system developed to make it as easy and low cost and guaranteed way of trading and adjusting price exposure on either side of the transaction.”

More exchanges were formed in the decades to come, including the Kansas City Board of Trade in 1856, the forerunner to the Minneapolis Grain Exchange in 1881 and the New York Mercantile Exchange in 1882.

“Once we started creating future contracts, other ideas developed,” Irwin said. “The whole system took some time to develop. But by the 1870s and 1880s, we had pretty recognizable futures trading comparable to today.”

Within these exchanges, the primary method of trade was open outcry, where buyers and sellers were able to see and hear each other in order to make bids and offer prices. An individual could take a place in the “pit” or “floor” and engage with traders, or they could commission a floor broker who would trade on their behalf.

“Traders in the pit conducted business among themselves, while buyers and sellers of the security in question relayed bid and offer prices to their representative floor brokers,” FXCM said.

Technology impacted the exchanges and trading early on, through the adoption of the telegraph, ticker tape and telephone. The telegraph, invented in 1832, allowed for distribution of financial newsletters in areas far away from the marketplace, according to FXCM, a provider of online foreign exchange trading and related services. By 1856, broker-assisted buying and selling of exchange-based securities was possible through telegraph.

The stock ticker, first put into action in 1867 in New York City, allowed for up-to-the-minute stock quotes origination at the New York Stock Exchange nationwide.

Invention of the telephone in 1876 introduced a new method of communication and by 1920, 88,000 telephones were in service on Wall Steet. As long-distance connectivity grew, the telephone became the industry standard for remote interaction with the marketplace, FXCM said.

“The inventions of the telegraph, ticker tape and telephone all contributed to the growth of marketplaces and exchanges in the US and Europe,” FXCM said. “When coupled with the computational power developed by the breakthroughs in information systems technology, the stage was set for the rapid evolution of computerized trading systems and electronic trading.”

You might also enjoy:

Overcoming obstacles and chasing innovation, the pet food industry prepares for its promising future.

Today’s meat and poultry processors carefully manage expectations to feed people, preserve the planet and deliver profits in the future.

Slaughtering and processing facilities where meat and poultry are manufactured have improved dramatically over the past 100-plus years.

The roots of electronic trading and digitization of the markets dates back to the 1960s and the use of streaming real-time digital stock quotes. Brokers could get specific market data on demand without having to wait for the ticker tape, FXCM said.

With the formation of the National Association of Securities Dealers Automated Quotations (NASDAQ) was the “opening of Pandora’s Box for the trading industry,” FXCM said. It used cutting-edge information systems to create a strictly digital trading platform, one that other exchanges wanted to follow.

By the 1990s, personal computers were becoming more powerful and internet connectivity was improving and the push toward automated markets overtook the open outcry system. In 1992, futures contracts began trading electronically on the CME Globex platform. In 2002, MGEX launched cash-settled corn and soybean contracts on its electronic trading platform with wheat futures and options following in 2003.

Adoption of electronic trading moved swiftly. In 2004, electronic trading accounted for 61% of all CME volume; by 2015, 99% of futures contracts were traded electronically.

As electronic trading took off, open outcry died. MGEX closed its trading pits in 2008, KCBT ceased to exist in 2015 and NYMEX went completely electronic in 2016.

With no need for traders on the floor, the exchanges themselves started consolidating at a rapid pace. The CBOT and Chicago Mercantile Exchange merged to form CME in 2007, and a year later, CME acquired NYMEX. CME acquired the KCBT in 2012 and consolidated its trading floor with the Chicago operations in June 2013, just two years before KCBT closed for good.

CME, the lone holdout in open outcry trading, announced just this year that it will permanently close most of its physical trading pits, including those for grain trading. They closed March 2020 due to the outbreak of the COVID-19 pandemic.

With the closure, ag products like corn and soybeans will not have any human-to-human interaction in the pit.

“With the trading floor gone, you lose that atmosphere, that place where people gathered, where they not only made trades but traded information,” Ehmke said. “You kind of miss that. You also miss a lot of nuances in the pit. For instance, a trader could tell you if they see a bull market coming because they could hear it in the way people talked, if they were louder. You’re not seeing the human face anymore; you’re not hearing the rally in the market.

“You lose those other soft senses that a lot of people had made a career of. They could feel the market.”

But in open outcry, the volume of trading was constrained by human beings’ shouting at each other, Irwin said.

“So the total capacity to trade and the speed at which you could trade was constrained to a set of human beings in a physical place,” he said. “With electronic trading you’re now trading literally at the speed of light and the only capacity constraints are the size and speed of the servers that the futures exchanges use. That’s the big reason why trading was so quickly adopted and why pit traders have gone the way of buggy whips.

“Electronic trading isn’t perfect but it’s faster, with very few capacity constraints. It’s a much cheaper way of trading and overall it’s probably a fairer way of trading.”

Ehmke said electronic trading also has brought anonymity to the market, which is both an advantage and a disadvantage.

“There’s less to read in the marketplace because you don’t know who’s behind it,” he said. “In the pits, you could clearly see if it’s a commercial grain trading company.”

If a broker had a big deck of orders in his hands before the market opened, it was obvious he was going to be doing a lot of business that day. In response, people would start bidding up grain, he said.

“That was one of the limitations in open outcry, the anonymity was hard to come by,” Ehmke said. “It wasn’t hard to figure out who was behind a trade. That’s all gone away. That’s what people want; they want the anonymity and the ease of clicking and doing their own trade. Going through a broker was more cumbersome, more costly and more time consuming.”

Early on, electronic trading was like the Wild West, with smart traders figuring out ways to create an edge, said Angie Setzer, co-founder and partner in Consus, LLC, which provides individualized marketing and agronomic solutions to farmers and grain buyers. She started her career as a cash grain broker before becoming vice president of grain for Citizens Elevator.

“For a lot of the big companies, the lack of transparency was beneficial to them,” she said. “That’s what pushed electronic trading at such a fever pace. Early on I thought there’s no way this would replace us; the human element was too important. I didn’t imagine within eight years we’d go from 90% pit traded to 100% electronic. I never dreamed it would go that fast.”

After electronic trading, there was much talk about the possibility of blockchain, a decentralized digital ledger with records called blocks that is used to record transactions, could replace existing trading platforms. But that hasn’t happened yet, Ehmke said.

“Blockchain is a different type of technology that records information along the blockchain where you can see all the transactions of a commodity that’s being traded, like crypto currency,” he said. “If you can trade crypto currency, you can trade a bushel of corn. Not so much. The problem is how do you trace a bushel of corn, because it is getting commingled in the system. What bushel are you precisely tracking? There’s a limitation with using that technology with commodity trading.”

The purpose of blockchain is to make things more efficient; that simply isn’t needed in commodity trading, Ehmke and Setzer said.

“We already have something that is pretty easy,” Ehmke said. “It’s hard to make it simpler than what we’ve got now. I don’t see how blockchain has any chance of disrupting those services. We still need to have some sort of instrument to lock in future prices and I don’t know that blockchain is the tool to do that.”

But, Setzer said, blockchain might have a role in food safety and production.

“I’m not sure it will have a big influence when it comes to trading and turning bushels into cash,” she said. “As far as making sure we know what chemical has been applied or what seed has been planted, I definitely see a role for that, and I see it stepping up in the next 10 years, especially for growers looking for a premium.”

A bigger disruptor to the way commodities are bought and sold will be the changing role of the grain elevator, Setzer said. With so much information available, and the ability to trade without a broker, farmers may choose to bypass the elevator and do their own marketing and selling.

Many farmers are already maximizing what they get from the land, so the next opportunity to enhance value is to run their farms like a business, Setzer said.

“Nowadays farmers can be connected to a network of people they’d not be able to work with otherwise and it’s opened the door for farmers to trade like an elevator,” Setzer said. “I’ve seen more of this education and more of this discovery that there’s value in being able to control the bushel beyond the harvest. Some farmers know more about market structure fundamentals than even some experienced merchandisers. That’s going to continue to happen, especially as the next generation takes over the farm.

“That’s changed a huge part of the elevator industry and will continue to change the elevator industry going forward. Country elevators will always have a role but the ones that remain will provide flexibility and alternative resources.”

The number of cooperatives is declining, the amount of on-farm grain storage continues to increase, and the size of farms continues to increase, Ehmke said.

“We’re going to see more and more companies contracting directly with growers because they have the acreage and the storage, and they can segregate,” he said. “There’s going to be pressure on the grain cooperatives and merchandisers to innovate around that.”

The continued push toward consolidation is a definite market disruptor, Ehmke said, that will have some impact on grain trading companies and agribusinesses in general.

“If there’s going to be any disruptors, I think perhaps there might be some type of technology that could expedite the process of bringing the farmer and consumer closer together,” he said. “What does that look like? I don’t know. We’re going to innovate those technologies to make it easier to capture that value up the value chain.

“When you’re talking about the realm of trading platforms, you never know what it will look like. You saw blockchain come but it didn’t end up being the disruptor yet that people thought it would be. So you always have to have an open mind in terms of trading commodities.”

Recently, multiple new companies have formed to provide electronic direct connections between farmers and end users, making it easier for farmers to market their own products and incorporating blockchain for transparency.

Dubai Multi Commodities Centre (DMCC) and CropData Technology launched in 2020 the Agriota E-Marketplace, a blockchain-based e-marketplace that acts as an agricultural commodity trading and sourcing platform. Through the platform, bulk buyers from the United Arab Emirates (UAE) are connected directly to farmers in India.

The marketplace has a range of services for contract, bid and money management, entity management, accounting, billing, reconciliation, analytics, fraud, risk and regulatory compliance management. Initially, it is handling cereals, pulses, oilseeds, fruits, vegetables, spices and condiments.

Farmers can connect directly to customers like food processing companies, traders and wholesalers. This cuts back on the number of intermediaries in a transaction, making the supply chain and traceability more efficient. The contract trading system will be powered by blockchain.

“This type of aggregation has the potential to empower local communities, deliver better quality farm-to-shelf products and expand the UAE’s long-term food security,” the DMCC said.

In October 2018, the world’s top agribusinesses announced plans to work together on an industry-wide initiative to modernize global trade operations. Archer Daniels Midland Co., Bunge, Cargill, COFCO, Louis Dreyfus and Viterra formed Covantis, a global agri post-trade platform for the execution of bulk shipments.

“In the history of the industry there has never been an initiative like this,” said Sorin Albeanu, head of commercial, Covantis. “This being achieved shows the industry agrees on the change that needs to happen and the challenges that need to be tackled.”

Existing post-trade execution processes are highly inefficient and there is hidden risk in how manual the processes are when it comes to exchanging contractual notices, passing through critical vessel information and identifying all the parties involved in buying and selling cargo.

Document workflow includes double data entry, slow communication and many last-minute changes, Albeanu said. In addition, documents are traded in a paper format and are transferred between many buyers and sellers, leading to delays, penalties and costs for having to issue letters of indemnity.

The Covantis platform, launched this February, covering soybeans and corn shipped and chartered out of Brazil, solves many of these issues. Soybean meal was added in August and there are plans for Covantis to expand into the United States and Canada in the first quarter of 2022. Argentina and the Black Sea region are also not far back on the list. Additional commodities such as wheat, sorghum, barley, oils and more will be added.

So far, 20 agriculture groups have signed up and more than 80 different legal entities active across the world were set up on the platform.

“Initially we focused on onboarding companies that act as shippers, FOB traders and charterers, allowing them to speed up the exchange of contractual notices, messages and documents,” Albeanu said. “With new functionalities being delivered, we have started to onboard CFR buyers, therefore covering the supply chain from port to port.”

The use of blockchain enables secure, real-time exchange of data, while increasing efficiency, reducing risk and costs.

“The platform is geared around creating visibility of long FOB and CFR strings of buyers and sellers that trade with each other the same cargo, the exchange of standardized contractual notices, messages and other vessel-related information, and improving the documents exchange workflow,” he said.

Through these capabilities Covantis is looking to improve efficiency and reduce errors, speed up communication and documents presentation, payments and therefore decreasing working capital and the risk for penalties.

Additionally, by digitizing the post-trade execution processes Covantis creates an audit trail for the actions and data exchanged between parties, a single source of truth in case of disputes and enhanced security for how data is exchanged, therefore reducing the risk of forgery.

Many times new technology meets with resistance, which slows its acceptance. Albeanu said Covantis has the backing of its shareholders not only in terms of investment but also in terms of data exchange and platform usage.

“Considering this support and the global agri firms that have already joined the platform, we are confident that we will achieve our objectives in terms of adoption. Even if we are live for only 6 months we have already seen over 60% of the Brazil flows, executed by charterers, being captured in the Covantis platform”” he said. “The time for change to happen is now.”

April 3, 1848 —The Chicago Board of Trade (CBOT) is founded as a cash market for grain. Forward or “to-arrive” contracts begin trading at the CBOT almost immediately.

1856 —The Kansas City Board of Trade is established by local Kansas City merchants as a means of trading grain.

1856 — Broker-assisted buying and selling of exchange-based securities was possible with the telegraph, invented in 1832.

1867 — The first “stock ticker” was put into action in New York City at the NYSE, transmitting up-to-the-minute stock quotes originating at the NYSE nationwide.

1876 — Futures trading begins at the Kansas City Board of Trade.

1877 — The CBOT begins publishing futures prices on a regular basis. Future CBOT documents considered this to be the beginning of “true” futures trading.

1881 — The Minneapolis Chamber of Commerce establishes an exchange, which in 1947 became the Minneapolis Grain Exchange.

1882 — The New York Butter, Cheese and Egg Exchange name is changed to NYMEX.

Sept. 15, 1920 — The Federal Trade Commission releases the first of seven volumes of its Report on the Grain Trade.

1920 — Nearly 88,000 telephones were in service in the Wall Street district.

Sept. 21, 1922 — The Grain Futures Act, predecessor to the Commodity Exchange Act, is enacted.

June 15, 1936 — The Commodity Exchange Act is enacted, replacing the Grain Futures Act.

1947 — The Minneapolis Chamber of Commerce is renamed the Minneapolis Grain Exchange.

1960s — Computer-based market data services began to take the place of traditional ticker-tape quotation services.

1969 — Building on digital exchange-based streaming quote technology, a company named Instinet introduced the first fully automated system for the trade of US securities.

1971 — Fully automated over-the-counter (OTC) trading became a reality with the formation of the National Association of Securities Dealers Automated Quotations (NASDAQ).

1973 — Grain and soybean futures prices reach record highs. This is blamed in part on excessive speculation and there are allegations of manipulation.

Oct. 23-24, 1974 — Congress passes the Commodity Futures Trading Commission Act of 1974, and it is signed by President Gerald Ford. The bill creates the Commodity Futures Trading Commission (CFTC or Commission).

1992 — Futures contracts began trading electronically on the CME Globex platform, beginning the transition from pit-based floor.

Dec. 21, 2000 — President Bill Clinton signs into law the Commodity Futures Modernization Act of 2000, which, among other things, reauthorizes the Commission for five years, overhauls the Commodity Exchange Act to create a flexible structure for the regulation of futures and options trading, clarifies Commission jurisdiction over certain retail foreign currency transactions, and repeals the 18-year-old ban on the trading of single stock futures.

Feb. 15, 2002 — MGEX launched cash-settled corn and soybean contracts on the MGEX’s electronic trading platform.

May 9, 2003 — MGEX launched financially settled hard winter wheat futures and options on the electronic trading platform.

2006 — NYMEX and CME begin transitioning toward electronic trading.

July 12, 2007 — The Chicago Mercantile Exchange and the Chicago Board of Trade announce the completion of their merger forming the world’s largest futures exchange, the CME Group.

2008 — CME Group acquires NYMEX’s holdings when NYMEX went public and was listed on the NYSE.

Dec. 19, 2008 — MGEX closes its trading pits.

2012— CME completes acquisition of KCBT.

July 2, 2015 — After the trading floor was consolidated with the Chicago operations in June 2013, the KCBT ceased operation in Chicago.

2016 — Under the CME Group umbrella, NYMEX goes completely electronic.

2021— CME Group announced that it will permanently close most of its physical trading pits, including those for grain trading.